Leveraging Preferred Industries in IACFB’s Lenders Directories

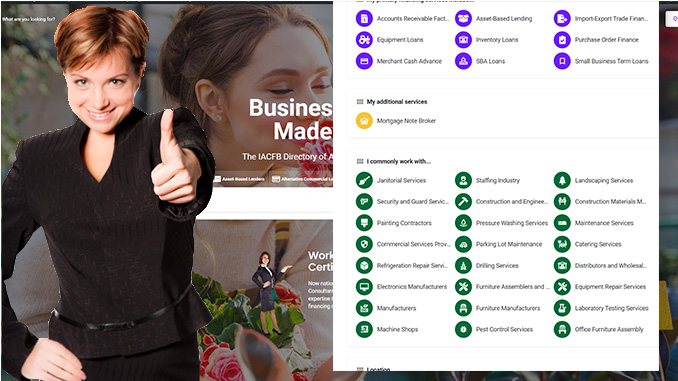

When researching options and opportunities regarding finance, businesses across various industries face unique challenges when it comes to securing suitable financing. As a broker or consultant listed in the IACFB’s Lenders Directories, selecting your “Preferred Industries” serves as a strategic move to showcase your expertise and familiarity within specific sectors. This powerful listing component not only highlights your knowledge of industry-specific financing but also makes it easier for business owners to locate local experts (just like you) who can help them navigate the complexities of securing funding tailored to their needs. IACFB allows Academy members to select up to 30 Preferred Industries for theri listing. Let’s explore how leveraging Preferred Industries can unlock new opportunities for brokers and consultants:

1. Demonstrating Industry Expertise:

- Selecting Preferred Industries allows brokers and consultants to showcase their expertise and deep understanding of specific sectors. Whether it’s healthcare, manufacturing, hospitality, or technology, highlighting your familiarity with industry-specific financing demonstrates your ability to provide tailored solutions that meet the unique needs of businesses within those sectors.

- By focusing on Preferred Industries, brokers and consultants can position themselves as trusted advisors who understand the nuances, challenges, and opportunities associated with each industry. This specialized knowledge instills confidence in potential clients and sets brokers apart from competitors who offer more generalized services.

2. Facilitating Targeted Searches:

- The new “Searchable Directories” feature within IACFB’s Lenders Directories empowers business owners to easily locate brokers and consultants with expertise in their specific industry. By selecting Preferred Industries, brokers ensure that their listing appears in search results when businesses are seeking financing solutions tailored to their industry.

- This targeted search functionality streamlines the process for business owners, allowing them to connect with brokers who have a proven track record of successfully securing financing for businesses within their industry. It eliminates the guesswork and uncertainty associated with finding a qualified professional who understands their unique financing needs.

3. Expanding Networking Opportunities:

- By aligning with Preferred Industries, brokers and consultants open doors to expanded networking opportunities within specific sectors. They can connect with industry associations, trade groups, and networking events focused on their Preferred Industries, allowing them to build relationships with key stakeholders and position themselves as go-to experts in the field.

- These networking opportunities not only enhance visibility and credibility within the industry but also lead to referrals and partnerships with other professionals who serve businesses within the same sector. It creates a virtuous cycle of collaboration and mutual support that benefits brokers, consultants, and their clients alike.

4. Driving Business Growth:

- Leveraging Preferred Industries in the IACFB’s Lenders Directories is not just about showcasing expertise – it’s about driving tangible business growth. By focusing on industries where they have specialized knowledge and connections, brokers and consultants can attract a steady stream of clients seeking financing solutions tailored to their specific needs.

- This targeted approach enables brokers to capitalize on niche markets, establish themselves as industry leaders, and generate new business opportunities within their Preferred Industries. It positions them for long-term success and sustainability in the competitive landscape of commercial finance.

Be Selective With Your Prefered Industries Selection

One of the key benefits of selecting Preferred Industries is the increased visibility and accessibility it provides to potential clients. Business owners often turn to directories like the IACFB’s Lenders Directories when searching for financing options tailored to their specific industry. By aligning with niche industries that are less commonly selected by other brokers, savvy professionals can stand out from the crowd and capture the attention of businesses operating within those sectors.

For example, imagine a business owner in need of financing for a parking lot line painting service. While this may be a niche industry with relatively few brokers specializing in it, a broker who has selected parking lot maintenance or related industries as Preferred Industries could be the only one that shows up in the directory search results. This unique positioning not only increases the likelihood of attracting clients within that niche but also demonstrates the broker’s specialized knowledge and ability to meet the unique financing needs of businesses in niche industries.

Moreover, being selective with Preferred Industries allows brokers to focus their efforts and resources on industries where they have genuine expertise, connections, and understanding of the market dynamics. Instead of spreading themselves too thin by trying to cater to every industry under the sun, brokers can hone their skills and deepen their relationships within select niches, becoming true subject matter experts in their chosen fields.

However, it’s important for brokers to strike a balance and not limit themselves too narrowly when selecting Preferred Industries. While niche opportunities can be lucrative, brokers should also consider including a mix of industries that are relevant to their target market and align with their areas of expertise. This ensures a diverse client base and maximizes opportunities for business growth and success.

Selecting Preferred Industries in IACFB’s Lenders Directories is a strategic move that unlocks a wealth of opportunities for brokers and consultants. By showcasing industry expertise, facilitating targeted searches, expanding networking opportunities, and driving business growth, Preferred Industries serve as a powerful tool for connecting brokers with businesses in need of specialized financing solutions. Embrace the potential of Preferred Industries and watch as your listing becomes a magnet for clients seeking expert guidance and support in their industry-specific financing journey.