ProjectionHub

In the world of commercial finance, understanding the nuances of SBA (Small Business Administration) programs is crucial for consultants and brokers aiming to provide comprehensive services to their clients. While the commission paid to referrers might seem modest at just one percent, the scale of SBA loans—often reaching millions of dollars—makes it a lucrative opportunity. However, many brokers, especially those focused on factoring, are not fully familiar with SBA lending. This gap in knowledge can lead to missed opportunities and unclaimed referral fees. Enter ProjectionHub, a platform that not only keeps brokers informed about the latest trends in SBA financing but also offers tools to connect them with the right SBA lenders.

What is ProjectionHub?

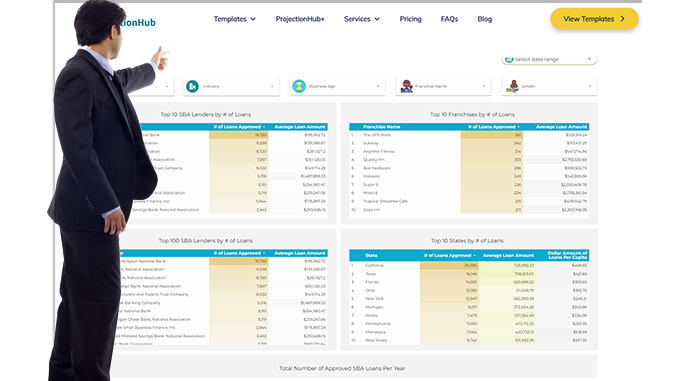

ProjectionHub is a specialized platform designed to support business owners, entrepreneurs, and finance professionals by providing a wide array of tools and resources for financial planning and funding. Among its most valuable offerings is its comprehensive SBA Lender Finder Tool, which is particularly useful for brokers and consultants who may not be deeply familiar with SBA lending.

The Importance of SBA Programs

SBA loans are a cornerstone of small business financing in the United States, offering favorable terms that are often unavailable through traditional lending channels. Programs like the 7(a) Loan Program, the 504 Loan Program, and the Microloan Program are designed to help small businesses obtain financing for various purposes, including working capital, real estate acquisition, and equipment purchase.

For brokers, the ability to refer clients to SBA lenders is a significant opportunity. Despite the relatively low referral fee percentage, the large loan amounts mean that even a one-percent commission can translate to substantial earnings. However, the key challenge lies in identifying the right lenders who can meet the specific needs of a client’s industry.

How ProjectionHub Supports Brokers

ProjectionHub addresses this challenge head-on with its SBA Lender Finder Tool. This tool allows brokers to search for SBA lenders based on industry-specific criteria, ensuring that their clients are matched with lenders who have a proven track record in similar businesses. This targeted approach not only increases the likelihood of loan approval but also positions the broker as a knowledgeable and valuable partner in the financing process.

Additionally, ProjectionHub provides detailed insights into the latest trends in SBA financing, helping brokers stay informed about changes in loan terms, new programs, and shifting lender requirements. This information is crucial for brokers who want to offer the most up-to-date advice to their clients.

Benefits of Using ProjectionHub

- Increased Referral Opportunities: By connecting with the right SBA lenders, brokers can significantly increase their chances of securing referral fees, even on large deals.

- Enhanced Credibility: Access to industry-specific lender information allows brokers to offer tailored advice, building trust and credibility with their clients.

- Staying Informed: ProjectionHub’s resources ensure that brokers are always up to date with the latest trends and changes in SBA financing, enabling them to navigate the complexities of SBA loans with confidence.

- User-Friendly Tools: The platform’s tools are designed to be intuitive, making it easy for brokers of all experience levels to find the information they need quickly and efficiently.

ProjectionHubs SBA Lender Finder Tool

For commercial finance consultants, ProjectionHubs SBA Lender Finder Tool provides you with the ability to search SBA Lenders by state / location and history regarding the types of loans they provide and for which industries. For example, if your client is in the construction industry and seeking a project loan in Florida, ProjectHubs SBA Lender tool will provide a history of not only loans to that industry, but also the amount. Additionally, this makes it easy to find all of the primary providers of SBA loan products nationwide. For those that prefer a “hands on” approach when representing SBALoan products, ProjectionHub has a suite of loan documents designed by industry that will allow you to earn your client’s respect immediatley as a commercial finance consultant.

For commercial finance consultants and brokers looking to expand their services and capitalize on the lucrative opportunities within SBA lending, ProjectionHub is an indispensable resource. Its SBA Lender Finder Tool and up-to-date industry insights provide the guidance and support needed to navigate the complexities of SBA financing, ensuring that brokers can confidently refer clients and earn referral fees, even on million-dollar deals. As the landscape of small business lending continues to evolve, platforms like ProjectionHub will remain at the forefront, empowering finance professionals to deliver exceptional value to their clients.