Across the United States—and especially in fast-growth states like Florida—single-family homes are no longer just places to live. They’ve become investment vehicles for private equity firms, hedge funds, REITs, and large-scale corporate landlords. This shift has driven up prices, limited supply, and locked out many first-time homebuyers and working families from homeownership.

But a growing chorus of policymakers and housing advocates are pushing back—with a strategy that may become one of the most transformative zoning solutions in modern history: the Build-to-Own Mandate and Owner-Occupant Zoning.

What Are Build-to-Own Mandates?

At the core of this policy is a simple idea: If a home is built in a designated zone for residential living, it must be occupied by the person who owns it—and used as their primary legal residence.

Under these mandates, cities or counties designate specific zoning overlays or districts in which:

- Only owner-occupied single-family residences can be built or purchased.

- The owner must reside in the home with voter registration, driver’s license, or other residency verification to qualify.

- Corporate ownership or investor holdings are prohibited in these zones except for transitional timelines.

Housing Affordability Hits a Record Low

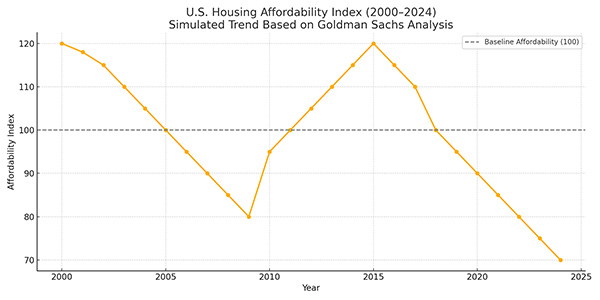

Recent data underscores the urgency of reform. According to Goldman Sachs, the U.S. Housing Affordability Index has now reached its lowest point on record—falling even below the peaks of the 2006 housing bubble. The index, which tracks the ability of an average household to purchase a median-priced home, has been devastated by a combination of rising home prices, stagnant wages, and persistently high mortgage rates. With Affordability now at crisis levels, especially in Sun Belt states like Florida, new zoning strategies are no longer optional—they’re necessary to restore balance to the market and prevent further generational disenfranchisement.

Key Features of the Policy

Residency Verification

To prevent abuse or shell companies posing as individuals, ownership eligibility would be tied to:

- Voter registration at the property address

- Homestead exemption filings

- Residency affidavits or other state-approved ID

Real Estate Tax Incentives

- Owner-occupants pay no real estate tax, or a deeply discounted rate based on property size and occupancy.

- Multi-family or investor-owned properties pay full commercial real estate tax rates or higher.

Investor Divestiture Period

- A grace period, such as five-years, allows corporate landlords in newly rezoned neighborhoods to sell their holdings gradually.

- After that, properties in owner-occupant zones can no longer be purchased or held by non-natural persons (LLCs, REITs, etc.).

Re-Zoning Flexibility

- Local governments can opt to rezone specific areas where rental concentrations have reached problematic levels.

- This allows a shift in housing availability without restricting the entire market.

Florida: A Testing Ground for Housing Reform?

Florida, with its dramatic price increases and the influx of institutional buyers post-2020, is exploring options to protect housing affordability and ownership access. Several counties have proposed:

- “Homestead-Only Zones”: Areas near schools and public resources reserved for owner-occupied housing.

- Investor Caps per ZIP code: Limiting the number of single-family properties held by corporations in any given area.

- Tax discount models for natural-person owners under a verified homestead exemption.

Though no statewide law has passed yet, local governments like St. Petersburg, Tampa, and Miami-Dade County are actively studying pilot programs.

Potential Benefits of Build-to-Own Zoning

BenefitDescription

Stabilized Neighborhoods Owner-occupants are more likely to invest in upkeep and community engagement.

Reduced Transiency Less turnover compared to short-term rentals or investor flips.

Improved Affordability Reduces speculative pressure on home prices by filtering out investor demand.

Democratic Access to Housing Helps restore the idea that homeownership is a path to economic mobility—not just a portfolio asset.

Risks, Pushback, and Legal Considerations

- Investor lawsuits: Large funds may challenge these policies as discriminatory or unconstitutional restrictions on commerce.

- Reduced rental inventory: If not balanced with multi-family development, the shift could squeeze renters in the short term.

- Enforcement complexity: Local governments would need systems to verify, monitor, and penalize improper occupancy.

- Developer resistance: Builders often sell entire developments to institutional buyers—this would restrict those deals.

However, the public appetite for reform is growing, especially as Affordability hits crisis levels and working families are priced out.

The idea that a home should be for living—not just for leveraging—is gaining traction. Zoning and build-to-own mandates, especially when paired with real estate tax reforms and transitional timelines, could reset the housing market in favor of actual residents.

Florida may be the testing ground for this new model of housing policy—one that reclaims single-family homes for families, not funds.