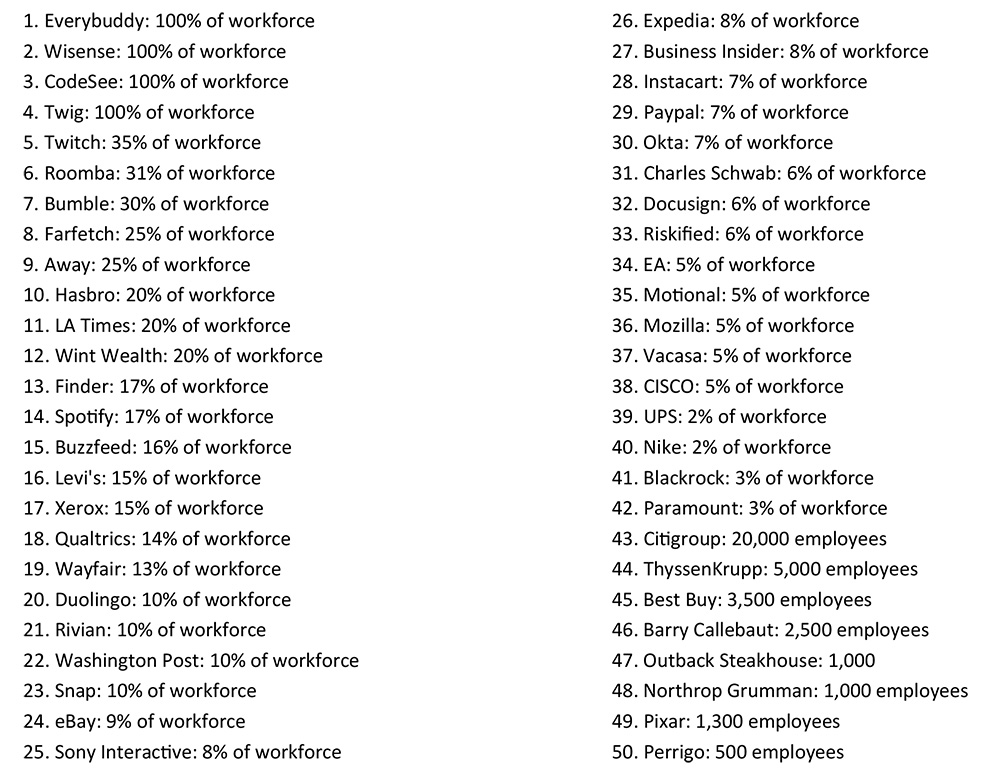

Last year (2023) was a bloodbath for the tech industry, with more than 260,000 jobs disappearing. For Silicon Valley, this was the worst 12 month period since the dot-com crash of the early 2000s. Workforce layoffs are mounting again. And…there are too many individuals that are at risk of losing their job. For the recently laid off, its not that they can’t get another job. There is plenty of work out there. The issue is, can they replace the job lost with another with the same income. The list below reference some indication of the “quality” workforce jobs lost just since the beginning of this year. The question is…can someone laid off from Citgroup’s 20,000 job decimation get another job at McDonalds? Of course! But what is the income loss?

Living on Credit Cards

The average American has a credit card balance of $6,501, an all-time high, according to Experian. That’s an increase from $5,910 in 2022 and $5,221 in 2021. And if you’re in credit card debt, you’re certainly not alone. Currently, almost 170 million consumers carry a balance on their credit card, according to TransUnion. In fact, Americans now owe a record amount on their credit cards. Total credit card debt reached $1.13 trillion in the fourth quarter of 2023, according to the Federal Reserve. The fact is, more and more Americans are existing and making ends meet every month simply because of credit cards.

But…Do Today’s Entrepreneurs Have the Right Idea?

But there is some light at the end of the tunnel, especially for laid-off tech workers. More and more are finding their entrepreneurial spirit and launching their own business. A recent survey of 1,000 knowledge workers in the U.S. backs this up. Over 60% said they have now lost trust in the stability and security of full-time employment. And nearly three-quarters of that number have said that the layoffs over the past two years have made freelance work more attractive than ever. In fact, fewer than half of laid-off workers are looking for another job in the same field. Over a quarter are electing entirely new fields, and another 25% are starting their own freelancing business.

Launching a New Entrepreneurial Business

So, being laid off is clearly one of the most stressful things that could happen to a person. But for many, there is a driving force to succeed in a new, and often completely unrelated to their old job. Instead, they open their own business and become an entrepreneur.

A new study from small business lender Clarify Capital examines both the benefits and challenges of launching a new enterprise after getting laid off. The Clarify Capital study found that a full 48% of those who launched a new business after being laid off actually CREDIT their layoff, giving them the motivation to become entrepreneurs, though they had given it some thought before. More than a quarter of study respondents said they started their business within three months of getting laid off, and another 30% said they started it within six months after getting laid off. Nineteen percent started it between 6 and 12 months after getting laid off, while 25% started their business one year or more after getting laid off.

Consider Commercial Finance Consulting

Could a freelance commercial finance consulting business be right for you? It could be. In fact, many former “techies” recently fired from the names above can excel on many types of “technical” centered opportunities due to their…

- Transferable Skills: If individuals have relevant skills and experience in finance, particularly commercial finance, this could be a viable option. Skills such as financial analysis, risk assessment, and understanding of financial markets are valuable in this field.

- Market Demand: Research the demand for commercial finance consultants in your area or target market. Are there businesses seeking assistance with financing, loan applications, or financial planning? Identifying a niche or specialization within commercial finance can also help attract clients.

- Networking: Building a network is crucial in consulting. Leveraging existing contacts in the tech industry or other professional networks can help generate leads and referrals.

- Regulatory Requirements: Depending on the jurisdiction, there may be licensing or regulatory requirements for offering financial advice or services. Ensure compliance with all legal and regulatory obligations.

- Business Acumen: Running a successful consultancy requires more than just financial expertise. Individuals must possess strong business acumen, including marketing, sales, client management, and administrative skills.

- Financial Considerations: While the cost of entry may be relatively low compared to other businesses, individuals should still consider startup costs, ongoing expenses, and potential income fluctuations. It’s essential to have a financial cushion to sustain oneself during the initial stages of the business.

- Flexibility and Independence: Being your own boss offers flexibility and independence, but it also comes with responsibilities and uncertainties. Individuals must be prepared to handle the challenges of entrepreneurship, including managing time, dealing with fluctuations in income, and handling client expectations.

- Continuous Learning: The financial industry is dynamic and constantly evolving. Individuals must be committed to continuous learning and staying updated with industry trends, regulations, and best practices.

In conclusion, starting a home business enterprise as a commercial finance consultant can be a viable option for those laid off from the tech industry, provided they have the necessary skills, market demand, and entrepreneurial mindset. It’s essential to conduct thorough research, assess personal strengths and weaknesses, and weigh the risks and rewards before embarking on this venture.