Dieter Ziggens started Ziggy’s Welding Specialties in Tampa, FL to provide onsite welding services for construction equipment. Ziggy’s has grown rapidly since opening in 2005 and currently has two (2) mobile welding trucks to provide services to local contractors.

Dieter Ziggens was pleasantly surprised to receive a call one day from a national steel building contractor in need of mobile welding services for some new projects. The contractor was beginning operations in Florida and would need an onsite mobile operator for at least the next 24 months to service new steel buildings being erected. The hourly fee offered was exceptional, however Ziggens would need to submit a single invoice each month for all work completed during that previous calendar month. The invoice would then be paid within 30 days. That meant Ziggens would need to wait as long as 60 days to be paid on the welding work he provided. Additionally, Ziggens would likely need to outfit another vehicle just to handle the steel building contractor’s additional business which was estimated to be $100,000 ti $150,000 per month. Ziggens was already billing about $150,000 per month with local contractors who paid in 30 days or less. This new business meant billings of roughly $250,000 to $300,000 monthly and Ziggens decided to talk to his banker about an immediate working capital loan.

The Bank Lending Officer Referral

At a meeting with a loan officer at his local bank, Ziggens was given the unfortunate news that the bank would not be able to help since they only offered real estate financing at the time and not asset-based loans. The loan officer said it really sounded like Ziggens could use something called commercial factoring which was a service the bank did not provide but he then provided Ziggens with the name of a local commercial finance consultant, Gene Jamieson, an IACFB broker he was well acquainted with and one who he had used previously when referrug factoring and alternative commercial finance business. When the bank could not provide capital services to clients, it only made good business sense to refer the unque financing requirements to a local and well-trusted broker before that specialized in factoring and also for the construction industry.

provide but he then provided Ziggens with the name of a local commercial finance consultant, Gene Jamieson, an IACFB broker he was well acquainted with and one who he had used previously when referrug factoring and alternative commercial finance business. When the bank could not provide capital services to clients, it only made good business sense to refer the unque financing requirements to a local and well-trusted broker before that specialized in factoring and also for the construction industry.

Meeting With the IACFB Consultant

After leaving the bank, a slightly concerned Ziggens called Gene the factoring consultant, who agreed to meet with him for a late lunch that afternoon. Jamieson explained to Ziggens that so long as the steel building contractor’s credit was good and had a good history of payments, factoring would be the perfect solution to be able to say “YES” to the new contracts and to begin the work. While at lunch, the broker asked a few questions about Ziggen’s Welding Specialties and how it was currently financed. To Jamieson the factoring consultant, it looked like a perfect opportunity to provide a factoring facility for Ziggens making it possible to finance the job. So…while at lunch Jamieson helped Ziggens fill out the short IACFB factoring application and when the lunch meeting was concluded, Jamieson quickly set up a conference call with IACFB to discuss the possible factoring arrangement for Ziggens Welding Specialties.

Quickly Providing a “Terms Sheet”

Although factoring in the construction industry requires a “Specialty Factor” to provide the unique services necessary to make it work, IACFB Directory of American Factors and Lenders included dozens of factors that routinely provide sub-contractor factoring services. IACFB staff first contacted Ziggens with just a few additional questions and within a few hours, Ziggens had receives a proposal, called a “Terms and Conditions” which outlined a new factoring arrangement (called a factoring facility) for Ziggens Welding Specialties. Withing a very short time, the factor’s underwriting department researched both Ziggen’s company for any exisitng current loans outstanding or UCC filings that would prohibit a factoring arrangement being provided and underwriting also check on the credit history of the steel building contractor. Both wer found to be good so factoring contracts were sent to Ziggens using an overnight courier. The factor also requested Ziggens to provide a current accounts receivable aging report be included. This would provide Ziggens’ other clients and once received, the factor’s back office could approve the additional customers for factoring as well.

The First Factoring Advance

Within 48 hours, Ziggy’s Welding Specialties was provided with a $500,000 factoring credit facility. And even though he had not started the services for the new general contractor, Ziggens could now begin getting factoring advances on all of his current invoiced receivables. This provide Ziggens with the ready capital to purchase an additional truck and new welding equipemnt to expand his operation. Additionall, and now by factoring all of his invoices, he had much more time on his hands since the the factor would act as his accounts receivable finance and management team. The factor’s back office staff would always be avaialble to check the creditworthiness of any new prospective customer for Ziggins so he was now ressonably assured that those he provided services for always paid on time.

Jamieson’s Factoring Commissions

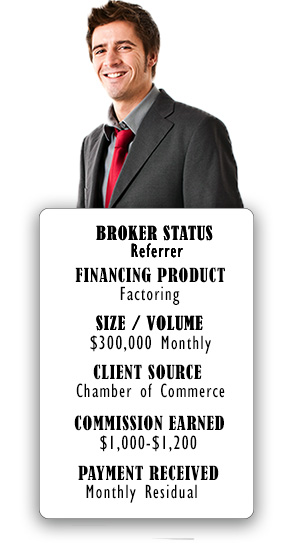

Jamieson, the IACFB broker, had met over a dozen local lending officers at the many after-hours functions sponsored by the local Chamber of Commerce and this particular loan officer had already forwarded several other possible clients to him. Jamieson was also a member of a local Rotary Club as well as a very active local Kayak Fishing Club. For him along with LinkedIn, these three local organizations were all he required to get prospects and cleint leads and his business as an IACFB Consultant was already earning him over $7.500 monthly. The new referral of Ziggins now had the possibility of pushing his monthly earning over the $10,000 a month mark. FACTORING COMMISSION EARNINGS: $1,000 – $1,250 per month.