Why Brokers Are Now the First Line of Defense Against Fraud

For many years, child care centers, medical day care facilities, and nonprofit social service providers represented a dependable niche for factoring brokers. Government-funded receivables were widely viewed as some of the safest collateral in commercial finance: strong payors, recurring billing, and predictable cash flow needs.

That perception has changed.

As large-scale fraud investigations tied to government-funded programs continue to unfold across multiple states, factoring companies have become increasingly cautious—particularly when underwriting receivables tied to child care, adult day care, and social services. In today’s environment, brokers are no longer just originators of opportunity; they are the first line of defense against reputational, financial, and legal risk.

Why Factors Are Now Reticent to Fund This Industry

The core issue facing factors today is not whether government agencies pay—they do—but whether the receivables themselves are legitimate.

Recent investigations have uncovered patterns of systemic abuse involving:

-

inflated attendance claims

-

billing for services not rendered

-

fabricated documentation

-

shell nonprofits

-

overlapping ownership structures

-

and improper reimbursements

As a result, many factors now treat these deals as high-scrutiny transactions, even when the payor is a state or federal agency.

For brokers, this means that deals once considered “easy approvals” now face:

-

longer underwriting timelines

-

lower advance rates

-

increased documentation requirements

-

or outright declines

Industries and Business Types Under Heightened Scrutiny

While not every provider in these categories is problematic, the following business types are currently receiving heightened attention from underwriters, regulators, and auditors:

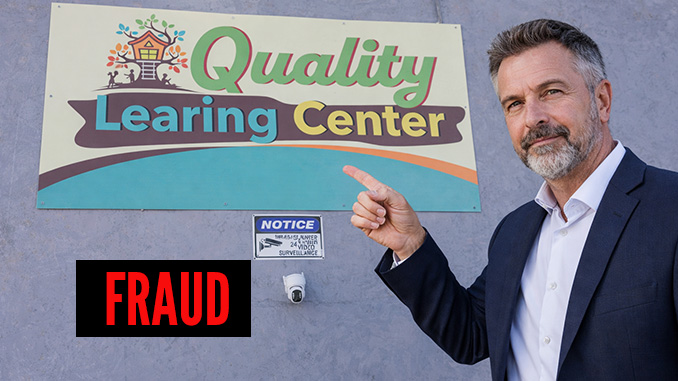

Child Care and Early Learning Centers

-

State-subsidized child care providers

-

Centers billing child care assistance programs

-

Facilities with rapid enrollment growth

-

Providers billing multiple programs simultaneously

Adult and Medical Day Care Facilities

-

Medicaid-funded adult day care

-

Medical day programs billing state agencies

-

Facilities with unusually high utilization rates

Nonprofit Social Service Providers

-

Organizations dependent on government reimbursements

-

Community outreach and support nonprofits

-

Entities billing nutrition, housing, or care programs

Home Health and Personal Care Services

-

Medicaid or state-funded home care providers

-

Providers billing through managed programs

-

Agencies with high staff-to-client ratios on paper

Government Grant and Reimbursement Models

-

“Cost-reimbursement” structures rather than true receivables

-

Programs subject to audits, clawbacks, or offsets

Each of these segments now carries elevated risk, particularly when documentation is incomplete, operational scale seems inconsistent with physical capacity, or ownership and management structures lack transparency.

The Broker’s Role: First Line of Defense

In this environment, brokers cannot rely solely on the perceived strength of the payor. Instead, they must act as pre-underwriters, asking hard questions before a deal ever reaches a factor.

Effective brokers now:

-

verify licensing and compliance status

-

review billing methodologies

-

assess whether operational scale matches physical reality

-

identify red flags such as sudden growth or vague ownership structures

-

confirm that receivables are true invoices—not reimbursements or grants

Submitting poorly vetted deals not only damages broker credibility—it can jeopardize long-term relationships with funding partners.

Should Brokers Still Target This Industry?

That is the strategic question every broker must now answer.

The reality is this: child care and social services receivables are no longer a “low-friction” niche. While some factors still participate selectively, many have stepped back entirely or imposed stringent restrictions.

For brokers—especially newer brokers or those building long-term referral credibility—it may be prudent to reallocate marketing efforts toward industries with:

-

clearer documentation

-

private-sector payors

-

lower fraud exposure

-

simpler underwriting paths

Industries such as staffing, transportation, manufacturing, wholesale distribution, construction trades, and B2B services often present faster approvals and fewer compliance pitfalls.

Some Final Considerations

Factoring child care and social services receivables was once a reliable niche. Today, it is a high-risk, high-scrutiny segment that requires advanced due diligence, strong factor relationships, and disciplined deal selection.

Brokers must recognize that in the current environment, what you choose not to submit can be just as important as what you do. Protecting your reputation, preserving factor trust, and focusing on cleaner industries may ultimately produce more consistent income and fewer disruptions.

As the industry adjusts to newly uncovered realities, successful brokers will be those who adapt quickly, vet thoroughly, and align their marketing strategies with sectors that balance opportunity with manageable risk.